Kiva Iowa

We help diverse and vibrant small businesses all across Iowa and the Quad Cities access affordable capital and small business resources.

Borrow

Kiva is a global nonprofit microlending platform.

There is a lack of affordable microloans available to small business owners and budding entrepreneurs. It’s difficult to get capital unless you make it to a certain size, with a certain revenue under your belt. And if you’re a woman, a person of color, someone with a low or no credit score, it’s even more difficult.

To address this challenge here in the state of Iowa, NewBoCo is partnering with a global nonprofit organization called Kiva to create a statewide Hub for Iowa that gives these entrepreneurs access to a microlending platform to raise zero interest, zero fee, extended grace period loans from active lenders motivated by social impact. These loans range from $1-$15k and lenders can give as little as $25 at a time.

Interested in learning about lending? See our lending section!

1.

Submit a loan application

(1 to 2 hours)

In addition to some financial questions, we ask for a high quality photo and a personal and business story.

Tax returns, bank statements, and business proof aren’t required but will help borrowers qualify for larger loans.

2.

Kiva Review

(5 to 7 days)

Kiva reviewers also look at social factors to determine a borrower’s loan size, such as whether they have:

- Been endorsed by a Kiva Trustee (optional)

- Has an online presence for their business

3.

Fundraising

(1 to 45 days)

Private: Borrowers invite their friends and family (5 to 25 people) to support them with as little as $25 in a 15-day period.

Public: Borrowers have an additional 30 days to fundraise for the rest of their loan from Kiva’s global community of 2.1 million lenders.

Kiva US borrowers have over a 95% chance of being fully funded.

4.

Repayment

(12 to 36 months)

Repayments are made monthly via PayPal. Payments start 1 month after the loan is made.

Monthly repayments are calculated by taking the loan amount and dividing by the number of months in the loan term.

So a $10,000 loan with a 36-month term would have monthly repayments of $277.78.

Lend

By lending as little as $25 on Kiva, you can be part of the solution and make a real difference in someone’s life. 100% of every dollar you lend on Kiva goes to funding loans.

It's a loan, not a donation

We believe lending alongside thousands of others is one of the most powerful and sustainable ways to create economic and social good. Lending on Kiva creates a partnership of mutual dignity and makes it easy to touch more lives with the same dollar. Fund a loan, get repaid, fund another.

You choose where to make an impact

Whether you lend to friends in your community, or people halfway around the world (and for many, it’s both), Kiva creates the opportunity to play a special part in someone else's story. At Kiva, loans aren’t just about money—they’re a way to create connection and relationships.

Pushing the boundaries of a loan

Kiva started as a pioneer in crowdfunding in 2005, and is constantly innovating to meet people’s diverse lending needs. Whether it’s reinventing microfinance with more flexible terms, supporting community-wide projects or lowering costs to borrowers, we are always testing and learning.

Lifting one to lift many

When a Kiva loan enables someone to grow a business and create opportunity for themselves, it creates opportunities for others as well. That ripple effect can shape the future for a family or an entire community.

Become one of over 2 Million lenders making a social impact in their community

Have questions about the lending or borrowing process? Drop us a line!

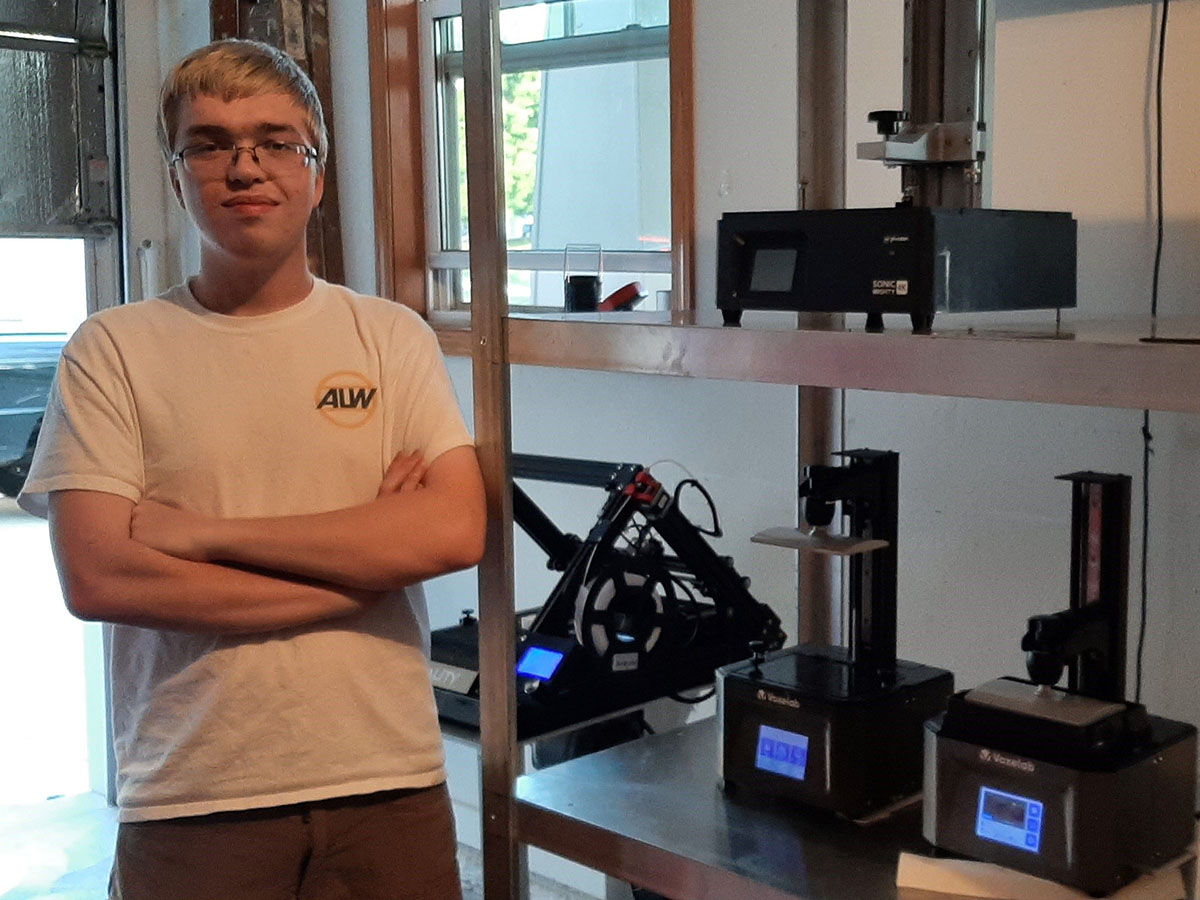

Our borrowers

Still have questions about borrowing or lending? Want help walking through the process? We’re here for you!

This Project is sponsored in part by the Iowa Economic Development Authority.